- Home

- News

- News from the South

- 2020 HBR Taiwan CEO 100 Ranking of Southern 6 Companies 56

2020 HBR Taiwan CEO 100 Ranking of Southern 6 Companies 56

2020 Harvard Business Review Global Traditional Chinese Edition (Taiwan's Top 100 CEOs) HBR ranks Taiwan's top 100 CEOs, accounting for 35% of all listed companies in Taiwan in terms of total market capitalization.

2020Harvard Business Review (Harvard Business Review; HBRGlobal Traditional Chinese Version (Taiwan)CEO 100 ;unyielding 〉評比出爐。 Today (8A prize-giving ceremony was held on March 28, 2012, with over50The total market capitalization of the companies attending the gathering, which featured the leaders of the most profitable companies in Taiwan, was more than $100 million.4.66The scene was glittering with "gold".2020 HBRTaiwanCEO 100The top companies, with a combined market capitalization of more than10The total market capitalization of all listed companies in Taiwan is34.97% for Taiwan The technology industry is the mainstay of the Bay Area economy. Among them, nearly half of them are leaders in the technology industry, which is the highest proportion. Chairman of Ho Shing Technology Mr. Hung Shui Shue was the most popular leader in the three years of this survey. Mr. Hung Chun-hoi, Founder and Chairman of Ru Hong, was the only non-technology leader to make it to the top ten.Total97individualCEOin order to100Three companies are on the list as business leaders.CEOTwo of them were also accounted for, including Xu Xudong with telecommunication The company's products include: CITIC and YUCA, Chen Tai-ming's products include: Giant and Chilisin, and Luo Zhi-xian's products include: Uni-President Supermarkets and Uni-President Enterprises. All have demonstrated outstanding leadership (see summary table).

Biennial survey enters its third year Expanding to the Top 100 for the first time this year

HBRGlobal Traditional Chinese version since2016Since 2007, the Taiwan's StrongestCEOThe first two editions of the ranking have selected50Strong, today. Expanded to100The survey methodology was modeled on that of the English version, and the same survey team was commissioned: INSEAD (China).INSEAD) part-time Prof. Nana B. Fontenoy Fombanus.Nana von Bernuth), with11Strategy & Management (Eleven Strategy & ManagementThe data consultant is an expert in the field.

A good leader must lead the business to growth and maximize the benefits to shareholders.HBRGlobal Traditional Chinese version first from Taiwan Stock Exchange (TSE) Listed companies, screening of top market capitalization300Strong Enterprise to2020surname Nian4moon30The closing date of the survey is on March 31, 2012, and those who are still in the serviceCEOFor the object. Excluding those who have been in office for less than two years or who have a criminal record, each leader's term of office will be evaluated based on the "industry-adjusted total shareholders' compensation ratio" and the "market value" of the company. The ranking is based on the long-term financial performance of the two indicators "change in value", and the top 10 companies are summarized.100Name.In order to conform to the actual operating conditions of Taiwan enterprises, theCEORefers to the actual decision-making leader, which may be a chairman of the board, president, chief executive officer or general manager.

Half of the entrepreneurs are still in charge of their own generation, and the average number of entrepreneurs in the last two generations has increased from 1,000 to 1,000.67More than 80% of them have passed the age of60Years

The percentage of technology leaders in the top 100 list is the highest, at47percent of the total; the second highest share was in the manufacturing and precision machinery industry, with because of24percent, then the service industry10%Finance8%(see table)1).

Further analyzing the academic qualifications of the awardees, due to the high proportion of the technology industry, the number of engineering degree holders is as high as40%; with operational management relatedQualified persons (MBA ;andEMBA) and also24%. Secondly, the 100 largestCEOThe entrepreneurs in the50percent, suggesting that many of the best businesses are still being run by the first generation of dedicated operators, and that the future is bound to be The challenge of succession. Perhaps because of the large number of founders, this TaiwanCEO 100Strong Average Age67Over 80% of them are in the60Over the age of 18 (see table)4).All but half are founders.39% are internal promotions, including second generation and family in-laws.18percent, professional manager promotions accounted for 21percent. This shows that most of the leaders in Taiwan have to be trained internally, and it is not easy to recruit them from outside.Moreover, the fact that the Top 100 are all men and none of them are women shows that there is still a ceiling for women in the workplace.

Zhang Zhongmou, Kuo retire, Shui Shue wins first title

Former TSMC Chairman Chang Chung-mou and former Hon Hai Group Chairman Kuo Tai-ming have remained in the top two for the past two years, and after their retirement, Hung Shui Shue, who has been the second runner-up for two consecutive years, won the title for the first time this year. Founded in1984From a small and medium-sized enterprise of aluminum alloy die-casting in Tainan, Kexing has gradually grown into a large-scale enterprise with a turnover of nearly one hundred billion dollars. Kexing is the first company in Taiwan to manufacture laptops with magnesium alloy mechanical parts, and has even become a global leader in the field of aluminum alloy die-casting.3C ;The product magnesium alloy die casting synonym, since the flood tree in the1997Took over as Chairman of the Board of Directors in 2007 and has been in office since then.4As of the end of the month, the company's market capitalization had grown by2,208The total shareholders' compensation ratio was $0.5 billion and the total shareholders' compensation ratio was $0.5 billion.2274%. The only non-technology factory in the Top 10 Hung Chun Hoi recorded the highest shareholder return2020 HBRTaiwanCEO 100Strong, the former20named19 Individuals who have been on the list for the past two years50 The top ten is a strong one, with seven of them remaining in the top ten for the second consecutive year. And seven of the top 10 remain in the top 10 for the second consecutiveTop 10New to the top 10 is Advantech's Liu Kezhen (#1). New entrants to the Top 10: Advantech Liu Kezhen (Ranking)3), Lik Sing Choi Tuk Kung (Ranking)5Jiao Youheng, Huaxinke (Ranking)10), and the previous year's ranking was also in the15Inside the name.

Among the newcomers, server maker Wistron is noteworthy, founded in2012 The company was officially listed last year, and its chairman, Mr. Lin Xianming, has reached the No. 1 position this year.22 Name.2019Earnings per share for the year (EPS(Gauda)36.42 The revenue has also increased from2014annual46 billion dollars.2019It's been a long time coming, but it's been a long time coming, and it's a long time coming.1,636 This represents an increase of nearly $100 million.36 Times.The only non-technology industry in the top ten is textile giant Ru Hong Enterprise, with founder and chairman Hong Chun Hai ranking the first in the list.5It is also the champion of total shareholders' return, with a total shareholders' return adjusted for industry fluctuations of up to9460This represents an increase from the "Total Shareholder Compensation Ratio" of No. 1 to No. 3.2Changhong Construction Li Wenzhao (Overall Ranking)24(used for emphasis)5516percent, higher by about72% (see table)2), the profitability is amazing.For "Market Capitalization Growth", MediaTek's founder Ming-Jie Tsai (ranked 7th overall) took the first place, with market capitalization growth during his tenure.8,723The company's market capitalization has grown by more than a hundred million dollars. The stock king, Eun-Ping Lin (Ranked #8), has also generated market capitalization growth during his tenure.5,289 Billions of dollars (see table)3). Food and construction sectors unaffected by the downturn common11Some of the listed essential industries are less susceptible to the fluctuations of the macro-environment, and their strengths are not to be underestimated. Five companies from the food-related industry are on the list, including Dacheng Han Jiayu (#1), Dacheng Hanking (#2), and Dacheng Hanking (#3).29), Jag Foods Tso Tak Fung (Ranking)31Miu Fung Keung, Luen Wah Industrial (Ranking)37Bee Cheng Wuyue, Taiwan (Ranking)48Unified Enterprises Law Chi-Sun (Ranking)80The construction and engineering industry has six entries.) Six companies from the Construction & Engineering sector are on the list, including Wah Koo Construction Chung Wing Cheong (Ranking18Li Wenzhao, Changhong Construction (Ranking)24)、Yu Junyan, Zhongding (Ranking)45The company has also achieved strong results in shareholder returns and market capitalization growth.

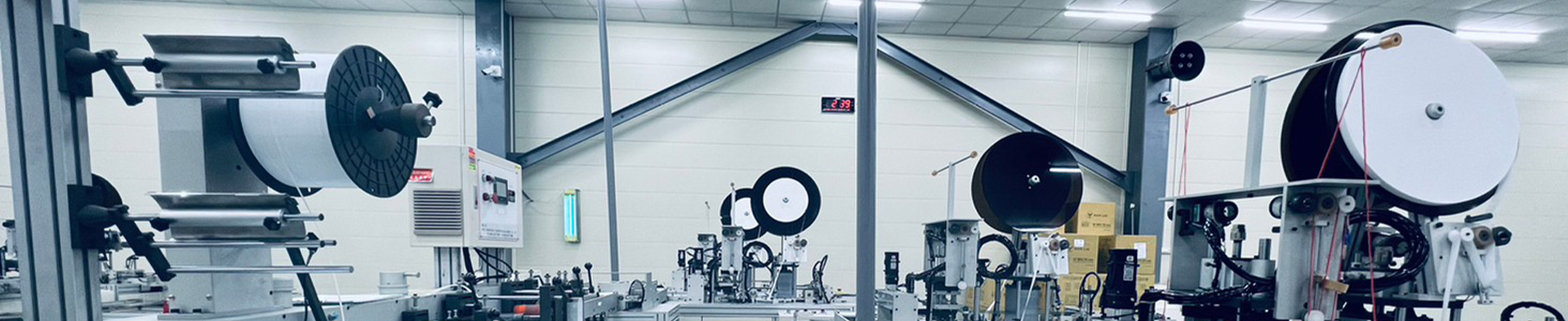

Unlike other construction companies that are susceptible to economic downturns, Wah Ku, led by Wing Cheong, is more efficient than its peers and adheres to a high turnover strategy.Total shareholders' return amounted to3154%, ranked first4Name.Mr. Miu Fung Keung, Chairman of UMC, is known as "Mr. Joint Venture", and has been making strategic alliances that extend beyond the flour industry into leasing, private biotechnology, industrial gas, petrochemicals, and computer information and communications. Industrial4.0and5GConcept Stocks Continue to Feverfrom2020 HBRTaiwanCEO 100The results of the survey show that the future development of enterprises will be accelerated in the direction of smart manufacturing, industrialization, and industrialization.4.0,5GConcept stocks close together. The development of automated, turn-off factory has been a period of time, there are several companies obviously benefit. Advantech, Chi Mao, Bank of China, Airtac, Maket, Deloitte, Delta Electronics, Silicon Power, and Holtek can all be listed as Industrial4.0Concept Stocks. Among them, Advantech's Chairman, Mr. K.C. Liu, has been working from2018th of the year13Jumped up to No. 1 in the current term3The company was ranked No. 1 on the list, leading Advantech's revenue to increase from2012annual276 This has grown from $100 million to $100 million.2019The number almost doubled in 2010 to541 ;The amount is $100 million, making a profit of $100 million,EPSThe dividend was at an all-time high.5G The conversation is heating up around the world, with full access to manufacturing, transportation, healthcare, and smart cities.2020 HBRTaiwanCEO 100There are also more than a dozen companies that can be categorized as5G The "Concept Stocks" include upstream passive components, printed circuit boards ("PCBs"), and other products and services.PCB),IC ;The list includes design and manufacturing, midstream networking equipment, and downstream terminal services, such as Giant, KDDI, Taishin, Taiwan Grand, and Far EasTone, etc. The only company on the list is Chunghwa's Chairman, Mr. P.Y. Wang. The only company on the list for networking equipment is the Chairman of Zhonglei, Mr. Wang Bo-yuan (Rank: 1).53).2008The company has been engaged in the R&D of small-sized base stations since 2007, and is the first company in Taiwan to lay out the related technology, and has recently been regarded as an indicator company of small-sized base stations.

HBRTaiwanCEO 100 ;With a strong emphasis on long-term business performance, those on the list must be characterized by a long-term vision, actively seeking a second, or even third, growth path. Despite the different types of industries and leadership styles of the companies on the list, they all share the same commonality of being able to create excellent long-term operational performance and become a solid economic force in Taiwan.

Magazine photo reprinted from: Harvard Business Review Magazine \ Yen-Man Chang Reporter